Decentralized finance (DeFi) has brought a whole new dimension for crypto traders to earn from their assets. With a lot of new protocols being developed in the space, a profit-earning strategy called “yield farming” was born. Here, we will list down the best yield farming pools that you should consider.

This will help you if you’ve decided to venture into this new DeFi concept that has gotten quite the hype in recent months.

Yield Farming

Before we get to the best yield farming pools, let us briefly discuss the basics of yield farming.

To simplify it a bit, yield farming refers to the process where cryptocurrency holders move their assets from one platform to another for maximum return. Their “yield” comes from the reward that protocols distribute, usually in the native token that they offer.

Yield farming covers mechanisms like liquidity mining and fund leverage. When we talk about liquidity mining, we are referring to the process of lending funds in a particular platform so they can have greater liquidity. Perhaps one of the most popular pools you might have already heard about is Uniswap’s.

There are a lot of yield farming pools today, and they offer different rates of return. It can be a little bit overwhelming to choose between which pools to move your funds to, which is why we’ll be listing down the best yield farming pools you can consider.

Best Yield Farming Pools

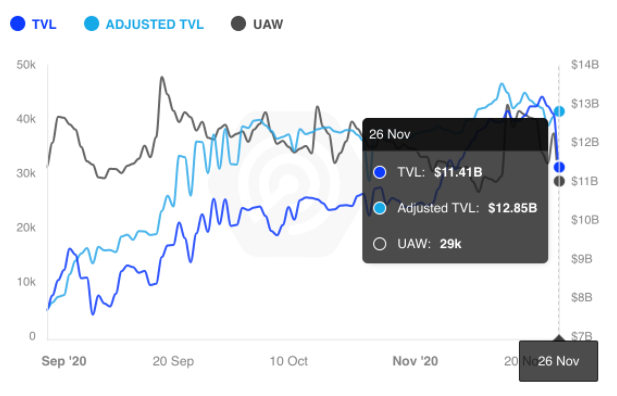

The total value locked (TVL) for DeFi protocols has increased so much in recent months, going from $1 billion to $14.2 billion in November. However, since most of the protocols offering liquidity mining options are Ethereum-based, increasing gas prices are some of the obvious concerns. Determining which pool to enter is crucial in coming up with an efficient yield farming strategy.

As of this writing, the TVL for DeFi is already at $11.41 billion, with an average of around 29,000 active wallets just from September to November. The biggest DeFi projects in terms of TVL is MakerDAO ($2.26B), WBTC ($2.08B), and Compound ($1.54B).

As we can see from the graph, the TVL for DeFi shows that the community has certainly moved on from the hype. However, it is important to note that the interest is still there.

Top Yield Farming Pools by Total Value Locked

Before getting your funds to protocols just based on their TVL, it is always advised that you perform your due diligence. This means checking the reputation of the protocol, its exposure to market risks, and the feedback of the whole community.

Here are the top 10 yield farming pools based on their TVL.

Source: CoinGecko (November 27, 2020)

Source: CoinGecko (November 27, 2020)

The biggest, as of this writing, is BarnBridge’s (BOND) USDC/DAI/SUSD pool, with a TVL of around $177 million. It has an estimated annual percentage yield (APY) of around 22.74%. One consideration on BOND, however, is that since it is fairly new and hasn’t been audited more than once yet.

Aave’s (AAVE) staking pool follows BOND at $173 million TVL, with 4.92% estimated APY. Since the protocol has been around for a relatively long time now, it has been through 3 protocol audits already.

The third is Sushi’s WETH/USDC pool, sitting at around $75 million TVL. It has an estimated APY of 29.8%.

Now, let’s look at top pools by liquidity as they are listed in the popular exchanges today.

Curve Finance

As of this writing, Curve Finance, with a TVL of $715 million, features some of the biggest liquidity pools in terms of TVL and APY. These are:

- renBTC/wBTC

- Total value locked – $294 million

- APY – 1.98%

- renBTC/wBTC/sBTC

- Total value locked – $121 million

- APY – 4.18%

- DAI/USDC

- Total value locked – $119 million

- APY – 9.29%

- DAI/USDC/USDT/BUSD

- Total value locked – $82 million

- APY – 7.73%

- DAI/USDC/USDT/sUSD

- Total value locked – $71 million

- APY – 9.56%

SushiSwap

SushiSwap has a TVL of $344 million. Its biggest yield farming pools are:

- USDC/ETH

- Total value locked – $77 million

- APY – 10.99%

- DAI/ETH

- Total value locked – $66 million

- APY – 12.74%

- USDT/ETH

- Total value locked – $46 million

- APY – 15.78%

- SUSHI/ETH

- Total value locked – $41 million

- APY – 31.75%

- YFI/ETH

- Total value locked – $33 million

- APY – 18.82%

Harvest Finance

Harvest has a TVL of $243 million. Its biggest yield farming pools are:

- CRV/renBTC

- Total value locked – $146 million

- APY – 5.11%

- WBTC

- Total value locked – $29 million

- APY – 0.99%

- FARM

- Total value locked – $18 million

- APY – 155.95%

- FARM/USDC

- Total value locked – $14 million

- APY – 4.53%

- renBTC

- Total value locked – $7 million

- APY – 4.77%

Risks of Yield Farming

Before you make a decision to enter yield farming, you have to understand the risks that go along with it. And while it can be profitable, a lot of planning has to be done before you achieve the financial objectives you’ve set.

Possibility of Losses from Smart Contract Lapses

Yield farming depends on smart contracts to automate transactions without the need for any supervising entity. If oracles fail to feed the right data, or a smart contract is not audited carefully, there is a likelihood for the system to fail. A case in point is Yam Finance, a protocol that was prematurely launched, which failed and resulted in millions of assets lost in a matter of hours.

Volatility

It is not just about the possible change in prices of the token pairs offered by yield farming pools. The composability of DeFi meant that many protocols could be affected by the changes in others. If a crypto exchange with a large TVL and interconnected with another protocol fails, there is a high likelihood of losses in the ecosystem built around it.

Conclusion

Yield farming has opened new profit-generating possibilities for cryptocurrency holders. And this mechanism has also spurred a lot of interest in the DeFi space too. However, it is important to understand the market before fully participating in it.

What everyone should remember is that APY is not the only metric we should look at when considering where to move funds. It changes rapidly, that’s why it is crucial to regularly monitor how these figures shift before we make our yield farming decisions.